SSSE’s core values are Fun, Integrity, Drive, and Others-First. As part of our commitment to Others-First, we strive to educate our investors, partners, and the general public about self storage. The Roman philosopher Seneca once said, “Luck is what happens when preparation meets opportunity”. This Frequently Asked Questions page is to serve as preparation for anyone interested in learning more about self storage and SSSE. The opportunities come when you sign up for SSSE’s investors list or buyers list by clicking the links in our menu bar. We hope to be lucky enough to work together.

If there are any questions that you have that are not answered below, please contact info@ssse.com

How much does a ground up development cost to build?

The cost to build a multi-story, temperature controlled, self storage facility is going to be one of the most expensive ways to build self storage. Self storage is primarily made of steel and concrete, with steel being a highly traded commodity susceptible to supply chain disruptions, geopolitical factors, and economic events. As a result, the cost to build any type of self storage can vary greatly from location to location, month to month. As of the time of this writing, we have seen the cost of building a class-A, multi-story, temperature controlled self storage facility range from $75 to $125 per square foot. Decisions like how many stories, how many elevators, smart locks, etc. will increase prices. There are ways to reduce costs like prefabricated components that are flat shipped and assembled on site. Involving your general contractor in the equity stack and incentivizing price reductions through a profit share structure can help ensure the best price and timely performance. We believe in getting multiple bids on every job.

How much does an adaptive reuse/conversion project cost to build?

The cost to do an adaptive reuse or conversion of a building into self storage is often less than the cost of building ground up. By using an already existing shell or “envelope”, you can reduce expenses dramatically depending on the condition of the shell. Self storage is primarily made of steel and concrete, with steel being a highly traded commodity susceptible to supply chain disruptions, geopolitical factors, and economic events. As a result, the cost to build any type of self storage can vary greatly from location to location, month to month. However, with an adaptive reuse or conversion project, you are not as exposed to the price of concrete and steel because not as much is needed with the exterior shell already existing. As opposed to structural components, the steel will be used for framing out units. As of the time of this writing, we have seen the cost of adaptive reuse or conversion projects of turning a building like a former big box store into self storage fall in the range of $45 to $85 per square foot. The condition of the shell- the roof, walls, foundation, electrical, HVAC, and fire suppression system- will greatly effect the project cost. If the shell is not in good condition, there becomes a break even point of using the existing shell vs. building a new shell from the ground up. Some pre-existing buildings will have enough ceiling height to consider building a mezzanine second level which will effect not only the price of the build-out but also the potential revenue the footprint of a given building can generate.

How do you price or value a self storage facility?

We price a self storage facility based on 3 different methodologies: financial, replacement, and highest use. Financial valuation is the most common and widely used methodology since self storage is a commercial real estate asset and commercial real estate is typically traded based on capitalization rates or “cap” rates. Determining a cap rate is taking the capital deployment (i.e. the purchase price) and dividing by the net operating income. It results in a percentage, like an 8% cap rate.

Net operating income is calculated by the annual gross operating income- all of the revenue that a facility generates before expenses- and subtracting the annual expenses the facility experiences. This results in the net operating income figure or “NOI”. Debt servicing is not included in the expenses used for calculating net operating income. Once you have a net operating income, you can reverse calculate the value of a facility if you establish what the market cap rate is. If it’s a nicer facility in a nicer, more populous area, it will most likely trade for a lower cap rate and thusly a higher premium.

A different valuation methodology from financial is replacement cost. This methodology is often best used for severely underperforming facilities, recent builds, or facilities in lease up because their financial performance may not be an accurate assessment of its current or future value. For instance, if you spend $10 million building a beautiful ground up development of a Class A self storage facility, and it just received certificate of occupancy so it is 0% occupied, financial valuation of the facility would put it at a value of $0. Actually less than $0 because there are expenses like property taxes and insurance that make it a negatively performing financial vehicle. 3 years from certificate of occupancy when the facility is leased up and performing, it now can garner a financial valuation of higher than $10 million potentially. Replacement cost valuation looks at how much it would cost to rebuild a facility using current construction costs but factoring in the wear and tear that the subject facility has experienced. So in that same scenario that we just discussed of the $10 million dollar new build facility, a replacement cost valuation would account for it costing $10 million to build. But now, construction and land costs could be higher and the fact that its already built as opposed to having to go through planning, zoning, and construction, provides a premium, so the replacement cost valuation could be even more than $10 million and it could make sense for the owners to sell as-is instead of leasing it up for a financial performance valuation. That’s not to say that people don’t buy facilities based on pro forma, or the potential financial performance of a facility. We certainly agree that should be accounted for in any valuation methodology, but we are not of the mindset where we want to pay the previous owner for our future work dollar for dollar.

Besides the financial and replacement methodologies we use to price and value self storage facilities, there is the highest and best use methodology. One of the benefits of self storage is that it can be built in a number of ways. If you have an empty box, it can typically be filled with smaller boxes making self storage. Highest and best use takes a look at the current performance and use of a property and determines if there is a better use for the property that would result in better performance. For instance, this could be converting non-temperature controlled self storage into temperature controlled. It could be taking larger units and making them into smaller units by using dividing walls because there is pent up demand for smaller units in the market and the rental rate per square foot is higher with smaller units. The most common scenario is a warehouse that needs to be converted into traditional self storage lockers as opposed to a wasted open space that is inefficient in its rental potential. Or a vacant piece of land that could have self storage built on it. Vacant land is not the highest and best use of that parcel. By changing the use to the best use of a property, it can bring a higher value to the property.

With these three different valuation methodologies- financial, replacement, and highest use- we can accurately value any sort of self storage property. Stating the obvious, the highest price with the best terms will usually get the deal done. So we employ these three different valuation methodologies to determine which route will allow us to make our best offer with the highest chance of getting accepted.

What cap rates do self storage facilities sell for in 2023?

The subject of self storage facility cap rates is one that does not age well. The bottom line is that self storage is a commercial real estate asset that has performed the best out of all real estate asset classes through recessionary periods so while other cap rates may be negatively impacted in the upcoming years, we believe that self storage will fair the best. We approach self storage cap rates from a 9 category matrix. There are 3 types of markets and 3 grades of self storage. Primary markets, secondary markets, and tertiary markets. Primary markets are major cities with high population density. We categorize that as populations of 250,000 or greater within a 10 minute drive time. Secondary markets we categorize as populations of 75,000 people to 250,000 within a 10 minute drive time. Tertiary markets are anything below that and because of the smaller populations, the density is usually less and it causes the trade area to increase sometimes to a greater than 10 minute drive time.

Class A self storage is mostly found in primary markets but we are seeing it more and more in secondary markets as the REITs and other institutional players expand out of the saturated primary markets into secondary markets. Class A is going to be newer, more expensive build types, multi-story, and temperature controlled. Class B is going to be slightly older, a mix of multi-story and single story drive up, with amenities like paved aisles, automatic gates, and potentially temperature control. Class C is going to be pretty much everything else: older drive-up units, possibly unpaved with gravel, compacted substrate or hopefully not just mud and grass. It is not an exact science and there is the largest range of quality facility within Class C which prompts some groups to use additional letters.

As you can imagine, a Class A facility in a primary market is going to trade at the lowest cap rate meaning that it is valued the highest, with the highest premium paid by buyers. A Class A facility in a primary market is going to trade at a lower cap rate than a Class A facility in a secondary market because of the security that a greater population and hopefully corresponding demand provides. So the Class C facility in a tertiary market is going to trade for the highest cap rate, or the lowest premium, because it is not as pretty of an asset, with potentially more risk.

We love to buy existing Class C and Class B self storage facilities for value add investment where we can improve their performance or even improve their asset class categorization. We like to build Class A self storage facilities because the premium to buy is incredibly steep so we are able to build them for less than purchase, lease them up, and either refinance at stabilization or sell them to market at the premium that grade asset garners. Historically, we have seen Class A facilities in primary markets trade for as little as 3% cap rates as long as there is room for increasing the financial performance. Over the past 3 years, we have bought Class C facilities in tertiary markets for as high as 12% cap rates. The rest of facility class and market combinations fit within that range, but now cap rates are rising because of interest rates.

Cap rates typically float above interest rates because of cash flow needs. So with the drastic increases in interest rates over 2022, we are seeing cap rates for all self storage facility grades and locations slowly rise to meet the higher interest rates. There is a lag in cap rates increasing and it is not directly proportional to the interest rate hikes because self storage is such a highly desired real estate asset especially for its recession resilience. As a result, we are seeing the highest valued self storage facilities trading at above 5% cap rates at the start of 2023.

The relationship between self storage facility values and interest rates can boil down to debt service coverage ratio (DSCR). Debt service coverage ratio is the calculation of net operating income versus debt payments. If the net operating income and debt service costs are exactly the same, it would be a DSCR of 1. Lenders typically want to see a DSCR of at least 1.25 so there is a buffer between loan costs and revenue from the facility, meaning that the net operating income of a facility can more than cover the debt payments. So as the cost of real estate loans go up with interest rate increases, the value of self storage facilities and other commercial real estate can go down unless the net operating income also increases to maintain bank required debt service coverage ratios.

How much money do I need to invest as a syndication participant?

How much you need to invest as a syndication participant is dependent on the investment opportunity. The syndication sponsors set the minimum investment amount and communicate that to the potential investors. This can be as little as $25,000 but can be much higher. There is often a maximum investment amount as well in order for the syndication sponsors to protect ownership interest so that a single investor does not come in and take over a deal or break a threshold which would require an investor to be a loan guarantor based on their ownership percentage. Each of our syndications at SSSE has the minimum investment and maximum investment established on a deal by deal basis with our lowest minimum investment at $25,000.

How does SSSE act on its commitment to “social stewardship”?

Our company on-liner is “tax-advantaged self storage with an emphasis on downside mitigation and social stewardship”.

By nature self storage mitigates downside and is tax-advantaged. In the Great Recession of 2007-2009, self storage dropped -3.8% in comparison to the S&P 500’s -22%. This was the smallest drop of any real estate asset class. From 2011-2018, self storage had the lowest default rate of any real estate asset class. When those rare few properties did default, the banks only lost an average 1.52% per default. Banks recognize the inherent downside mitigation of self storage and that’s why its one of their favorite assets to lend on.

We further emphasize downside mitigation with our rigorous underwriting and analysis. Each of our syndications and investments is required to have multiple exit strategies. With our robust pipeline of leads and opportunities, we are never in a position where we feel the need to take on a new acquisition or development because of pressure to deploy capital. We pick the best opportunities to move forward with when it makes sense to do so.

As for tax advantages, the government provides incentives for anything that creates food, jobs, or shelter. While self storage is not housing, it is real estate and has all of the great tax benefits like bonus depreciation. We consider tax benefits as part of our analysis process, and choose deals that will result in the greatest tax benefits.

Our company one-liner emphasizes social stewardship. We believe that self storage can be more than metal boxes. We are very fortunate with the opportunities that self storage affords us. One of those is the opportunity to give back to the communities our storage facilities serve and to make environmentally conscious decisions when designing our developments. Energy efficient materials, solar panels, electric vehicle chargers, green roofs, native species landscaping, and more are all considerations we take into account when planning and designing our new self storage facilities. Our primary focus in regards to social stewardship is participating and donating to local charitable causes for each of the communities our storage facilities serve. Self storage is an incredibly localized business. On average, 70% of renters come from a 3 mile radius of a self storage facility. This is an opportunity for us to really participate in our communities. Our charitable donations and participation is focused around food, shelter, and jobs. Some of our most common avenues for giving back to the areas we serve are local food banks, domestic violence shelters, and after school programs. Our renters trust us to store and protect their beloved belongings, and we want to go beyond that to protect and improve the communities that store our properties.

How does self storage compare to other real estate assets in regards to return on investment?

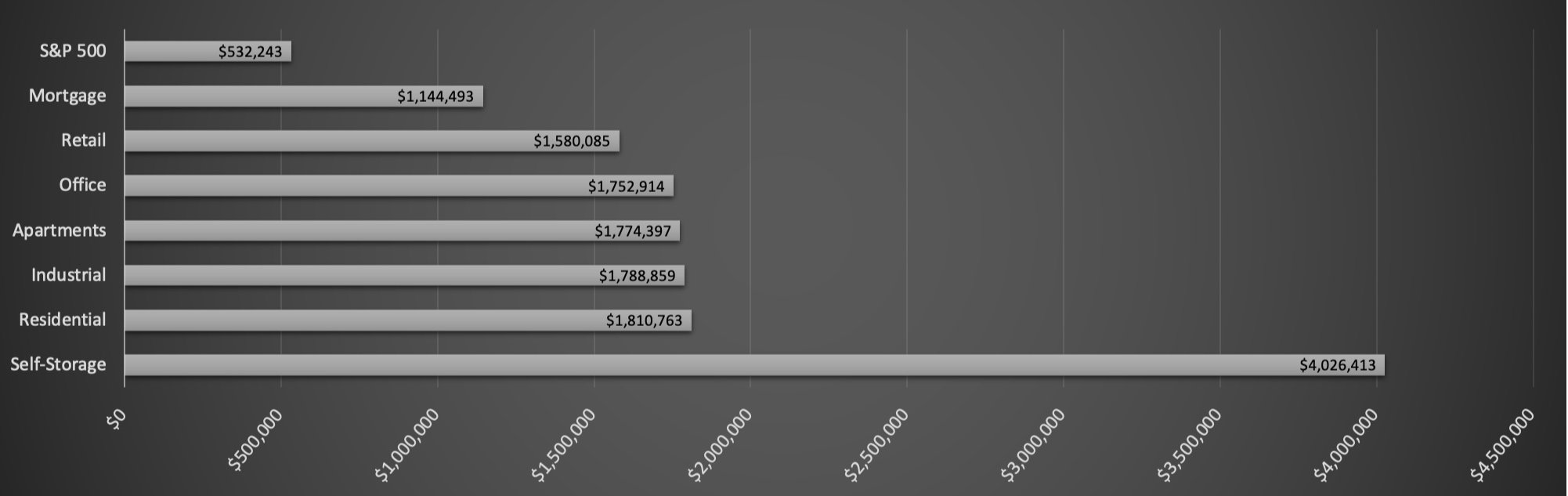

Self storage has the highest return on investment in comparison to any other real estate asset class. From 1994-2017, storage returned an annual average of 17.43%. Based on that annual average, $100,000 invested in 1994 would be over $4,000,000 as of 2017. In comparison, if you invested in apartment buildings over that same time, the $100,000 would be $1,774,397 as of 2017.

2017 Value of $100,000 Invested in 1994 Based on Average Annual Return by REIT Sector

Is self storage recession resilient?

From 2007-2009, self-storage dropped -3.8% in comparison to the S&P’s -22.0%. This was the smallest drop of any real estate asset class. Self storage had some of its best performing years during the COVID-19 Pandemic when some other real estate asset classes performed poorly. According to Trepp, a Commercial Mortgage Backed Securities research firm, of the 1,700 CMBS loans made to self storage in the first 3 quarters of 2020 only 3 were delinquent– that is a 0.17% delinquency rate . During the same time multi-family was defaulting at a rate 1,800% higher or 18x that of self storage.

Do banks like to loan on self storage?

From 2011-2018, self storage had the lowest default rate of any real estate asset class. When those rare few properties did default, the banks only lost an average of 1.52% per default. According to Trepp, a Commercial Mortgage Backed Securities research firm, of the 1,700 CMBS loans made to self storage in the first 3 quarters of 2020 only 3 were delinquent– that is a 0.17% delinquency rate . During the same time multi-family was defaulting at a rate 1,800% higher or 18x that of self storage. Lending on self storage is one of the safest loans a bank can make.

Is self storage easy to manage and operate?

Self storage often has one of the lowest expense ratios of real estate assets due to its minimal staffing requirements, simplified construction, and low turnover costs. By leveraging technology and online tools, self storage facilities can often be operated by a few key employees or even fully automated. The simplified construction of steel and concrete with reduced utilities results in lower ongoing maintenance. When a renter moves out, the turnover cost and process is not like a tenant moving out of an apartment; disposal and broom sweeping are all that are needed in most scenarios.

What is the ownership demographics of self storage?

Of the ~52,000 self storage facilities in the U.S., only 22% are owned by the 6 large REITS, and another 13% are owned by the next 100 largest operations. This leaves about 65% of facilities owned by “mom & pop” operators.

Is self storage subject to eviction laws?

Self storage is not guided by eviction laws. Self storage is guided by lien (property) law as opposed to eviction (tenant) law. This means self storage “loses” less days than any asset class that physically has people in it. When a renter is late on payment, their gate passcode is deactivated and/or their unit is over-locked. They are notified of their past due balance and if the delinquent unit does not come current, local lien law timelines are adhered to for the auction process. Typically, the lien and auction timeline allows for the recovery of balances owed and new rental to a paying tenant within 60 days.

Is the lien and auction timeline the same nationwide?

No, the lien and auction timeline is NOT the same nationwide. Each state has their own requirements for the lien and auction process. Typically, there are requirements of notification, a time period where the tenant has the ability to come current on balances owed, followed by public notice of auction, and then the sale of stored goods. Typically, the lien and auction timeline allows for the recovery of balances owed and new rental to a paying tenant within 60 days.

What is the break-even occupancy needed for self storage?

Un-leveraged self storage facilities have break-even occupancy figures in the low to mid 30% occupancy range. Leveraged assets have break-even occupancy figures in the low to mid 60% occupancy range. This is partially due to much lower overhead because of no “tenants, toilets, and trash”.

What is a reactive pricing model?

With self storage, you can adjust pricing based on real time supply and demand. When a certain type of unit (ex. 10’ x 10’) is in low supply in the market/facility, the pricing can raise by as much as 50%+ and tenants may still rent them. Conversely, when a certain type of unit is in high supply in the market/facility, the pricing can decrease in order to encourage rentals. While this may seem like a basic concept, it’s not one that is as easily implemented in other real estate assets like multifamily, and certainly not to the same premium as available to self storage.

Is rental income the only revenue stream available to a self storage facility?

Self storage facilities implement a large number of ancillary revenue streams. In addition to unit rentals, a facility can experience income from packing and moving supplies, lock sales, truck rentals, business center income, renters insurance commissions, vehicle parking, cell tower leases, billboard advertisements, and more.

What is the current demand for self-storage units?

The current demand for self-storage units varies depending on various factors such as location, market conditions, and economic trends. Generally, the self-storage industry has seen stable and consistent growth in recent years, driven by factors such as urbanization, lifestyle changes, and the growth of e-commerce. As of 2020, 10.6% of U.S households rent self storage. This is up from 9.4% in 2017. This provides a huge opportunity for growth since in theory, if we were to go from 1 in 10 households using self storage to 2 in 10 households, the national supply of storage facilities would need to potentially double. This sort of growth potential does not exist in many other real estate asset types.

What is the average occupancy rate for self storage?

The average occupancy rate of self-storage facilities varies depending on location, market conditions, and other factors. Typically, the average occupancy rate for self-storage facilities is between 80-90%. However, it is not uncommon for occupancy rates to fluctuate based on seasonal changes and local economic conditions. The self-storage industry as a whole has been stable and consistently growing, with high occupancy rates reflecting the growing demand for storage space.

According to the Self Storage Almanac and Radius+, as of 2022, the national occupancy was 93.4%.

What is the average rental rate for a self-storage unit?

The average rental rate for a self-storage unit varies greatly depending on factors such as location, unit size, and market conditions. On a national level, the average monthly rental rate for a standard 10x10 self-storage unit ranges from $50 to $200, with rates tending to be higher in urban areas and lower in rural areas. It is important to note that rental rates can fluctuate and can be affected by supply and demand, local economic conditions, and competition in the area.

According to Radius+, as of Q2 2022, historical national rental rates for non-temperature controlled units were as follows:

$56.65 for 5’x5’

$78.32 for 5’x10’

$120.13 for 10’x10’

$152.40 for 10’x15’

$177.45 for 10’x20’

As of Q2 2022, historical national rental rates for temperature controlled units were as follows:

$66.02 for 5’x5’

$98.83 for 5’x10’

$155.68 for 10’x10’

$203.77 for 10’x15’

$268.99 for 10’x20’

What is the market competition like for self storage?

The market competition for self-storage varies depending on location and the number of facilities in the area. In some markets, there is high competition among self-storage operators, while in others, there is limited competition. Competition can affect rental rates, occupancy rates, and the overall performance of self-storage facilities. The self-storage industry has seen significant growth in recent years, with new operators entering the market and existing operators expanding their portfolios. This growth has led to increased competition in some markets, which has driven innovation and improvements in the self-storage product offering.

According to Mini-Storage Messenger, in 2022 there were 51,206 self storage facilities up from 50,523 in 2021.