SSSE’s core values are Fun, Integrity, Drive, and Others-First. As part of our commitment to Others-First, we strive to educate our investors, partners, and the general public about self storage. The Roman philosopher Seneca once said, “Luck is what happens when preparation meets opportunity”. This Frequently Asked Questions page is to serve as preparation for anyone interested in learning more about self storage and SSSE. The opportunities come when you sign up for SSSE’s investors list or buyers list by clicking the links in our menu bar. We hope to be lucky enough to work together.

If there are any questions that you have that are not answered below, please contact info@ssse.com

How do I invest with SSSE?

At SSSE, we provide both accredited and non-accredited investors access to tax-advantaged self storage investments with an emphasis on downside mitigation and social stewardship. Our syndications range from acquiring existing value-add self storage facilities to expanding existing facilities, from converting vacant big box stores into self storage to building from the ground up.

At SSSE, we provide both accredited and non-accredited investors access to tax-advantaged self storage investments with an emphasis on downside mitigation and social stewardship. Our syndications range from acquiring existing value-add self storage facilities to expanding existing facilities, from converting vacant big box stores into self storage to building from the ground up. The first step to investing with SSSE is to fill out our investor onboarding webform. It is quick and easy and can be found on our website SSSE.com by clicking the “Investors” menu link in the upper left corner. Once you have submitted your investor webform, you will have the opportunity to schedule an introductory phone call with one of our investor relations team members. A scheduling program will automatically appear. After that, stay tuned for the next investment opportunity! If we have any active raises occurring that are a good fit for your investor profile, our investor relations team member will let you know on the call and will walk you through getting access to the investor portal. Otherwise, we typically will send out an email whenever there is a new investment opportunity. It will have the high level details including whether it is a 506(b) syndication (for both accredited and non-accredited investors that we have pre-existing relationships with) or a 506(c) syndication (for accredited investors only). There will also be a link to the investment opportunity’s web page! On the webpage will be more details including a short description at the top, followed by buttons to schedule a call, access the investor portal to review the documents, and a video summary. The investment process concludes with accessing the investor portal and signing the subscription documents and wiring funds through the investment portal. Our investor relations team will be there to help every step of the way.

What is an accredited investor?

Only accredited investors can invest in 506(c) syndications. We do both 506(b) and 506(c), so if you’re not yet an accredited investor, if you invest in enough of our 506(b) offerings, you’ll be headed in the right direction. The Securities and Exchange Commission sets the definition of an accredited investor.

Often we get asked, what is an accredited vs. a non-accredited investor. We get asked this because only accredited investors can invest in 506(c) syndications. We do both 506(b) and 506(c), so if you’re not yet an accredited investor, if you invest in enough of our 506(b) offerings, you’ll be headed in the right direction. The Securities and Exchange Commission sets the definition of an accredited investor. The definition is subject to change but as of the time of this writing, an accredited investor is someone who meets one of the following 3 requirements. 1. Income. You can be considered an accredited investor if you have a sustained annual income of at least $200,000 as a single investor, or $300,000 total if combined with a spouse’s income. 2. Professional. If you hold a valid Series 7, 65, or 82 license OR are a “knowledgeable employee” of certain investment entities. 3. Net Worth. Excluding the value of your primary home, if you have a net worth of $1 million or more, by yourself or combined with your spouse, you qualify to be an accredited investor. A couple reminders: part of the 506(c) syndication investment process will be verifying that you are an accredited investor, so “fake it til you make it” does not apply. Lastly, I am not an attorney or investment advisor. This information is purely for educational purposes. Please consult your legal and financial counsel for any questions, guidance, or advice.

How does SSSE underwrite properties?

Self Storage Syndicated Equities is committed to downside mitigation. Our underwriting process is our first step in minimizing risk. From the very first phone call or email we receive with an opportunity, there are at least 3 levels of underwriting that a deal must make it through prior to any consideration of investment.

SSSE is committed to downside mitigation. Our underwriting process is our first step in minimizing risk. From the very first phone call or email we receive with an opportunity, there are at least 3 levels of underwriting that a deal must make it through prior to any consideration of investment.

The first is our “back of the napkin” underwriting. Our acquisition team is fielding constant responses to our marketing efforts day in, day out. In order to be efficient and effective, they must collect a minimum threshold of information from a lead in order for it to be even considered an opportunity and continue to move through our process. That minimum information includes the contact information of the seller, broker, or wholesaler; the name and address of the property; size and/or acreage of the facility; current occupancy or zoning of the property; and current annual gross operating income.

With this information, we are able to identify an as-is financial valuation and replacement cost valuation for existing facilities. For development opportunities, we have standard build types that are possible based on the size of the lot and from that a range of value we can assign to the land with comparison to market value of similar listed and sold land. The purpose of the “back of the napkin” underwriting is to be able to provide an offer range as quickly as possible to the seller, broker, or wholesaler that will be fine tuned in later levels of underwriting.

If the lead passes our “back of the napkin” underwriting and becomes a potential opportunity, we perform our “underwriting lite”. This involves collecting readily available due diligence items and remaining information. Unit mix, pricing, expenses, recent capital improvements, needed capital improvements, management structure, build types, security components, insurance information, and more.

In our “underwriting lite”, we perform the “chicken pox test” on Google Maps, searching for storage in the nearby area to see how many red dots show in order to get a general sense of supply. We virtually drive the market using Google Street View to compare the subject facility to competitor facilities. We pull up census data to get a general understanding of population, trends, and demographics. We compare the subject facility’s unit prices to the 3 nearest competitor’s prices to see what sort of soft value add is available. We call the city building and zoning department to see if there are any active or applied permits for self storage development. Once we have completed underwriting lite, we should be able to solidify value and viability for the subject property. Beyond that, we have our full underwriting and analysis.

SSSE’s full underwriting and analysis takes all of the previous steps of our initial acquisition activities, formalizes them, and expands upon them. We have a full due diligence document checklist that the seller is required to submit prior to the due diligence period starting. We take all of the due diligence documents and audit them by recreating them within our standardized underwriting and analysis template. By auditing and recreating their rent roll, we are then able to create an accurate unit mix with each unit size’s range of rates accounted for.

In our full underwrite and analysis, we conduct an extensive competition study where we compare the supply index number, the competitors’ historic and current occupancy, and the subject facility’s historic and current occupancy in order to get an accurate assessment of the market’s supply and demand. The supply index number is determined by using satellite imagery and secret shopping to measure the size of each of the competitors and the type of storage the competitors provide. Using ArcGIS Esri Business Analyst we are able to map 1, 3 and 5 mile radii in addition to 5 minute, 10 minute, and 15 minute drive times, to establish our potential market and customer base. We analyze our potential market to determine population, income, housing and other metrics within the various radii. Dividing the population by the storage supply within our market radii provides us our supply index numbers which we compare against the state statistics provided by the latest Self Storage Almanac. Our competitor’s historic and current occupancy along with their unit rates is established through secret shopping. This underwriting triumvirate of supply index, subject facility occupancy, and competitor facility occupancy gives us as accurate of a market supply and demand study as possible. We are able to use the market supply and demand results along with the competitor unit rates matrix to determine what the market rates are and update the unit mix with the potential rental rates for each unit size.

By updating the seller’s unit mix with market rental rates gleaned from our competition study, we achieve a projection of gross potential income that can inform development and expansion plans. It allows us to project future years profit and loss in comparison to current income and expenses with downside mitigation factored in through stress tests, applying a range of decreases to income and an increases to expenses. We explore the various debt and equity structures available and the effects on cash after debt service and internal rate of return. Beyond the quantitative analysis, we collect qualitative information: physical appearances, amenities, opportunity zone qualifications, property insurance qualifications, FEMA flood map reference, police reports, and more. We order a Phase I Environmental Site Assessment, a Property Condition Assessment, drone photography, and a site walkthrough. In the scenario of an expansion, adaptive re-use, or ground up development, we order a third party feasibility study to verify our work and further mitigate downside risk for us and our investors.

When everything is said and done, we can identify if there are any changes needed to the purchase price, projections, or structure of each deal.

How much money do I need to invest as a syndication participant?

How much you need to invest as a syndication participant is dependent on the investment opportunity. The syndication sponsors set the minimum investment amount and communicate that to the potential investors. This can be as little as $25,000 but can be much higher. There is often a maximum investment amount as well in order for the syndication sponsors to protect ownership interest so that a single investor does not come in and take over a deal or break a threshold which would require an investor to be a loan guarantor based on their ownership percentage. Each of our syndications at SSSE has the minimum investment and maximum investment established on a deal by deal basis with our lowest minimum investment at $25,000.

How does self storage compare to other real estate assets in regards to return on investment?

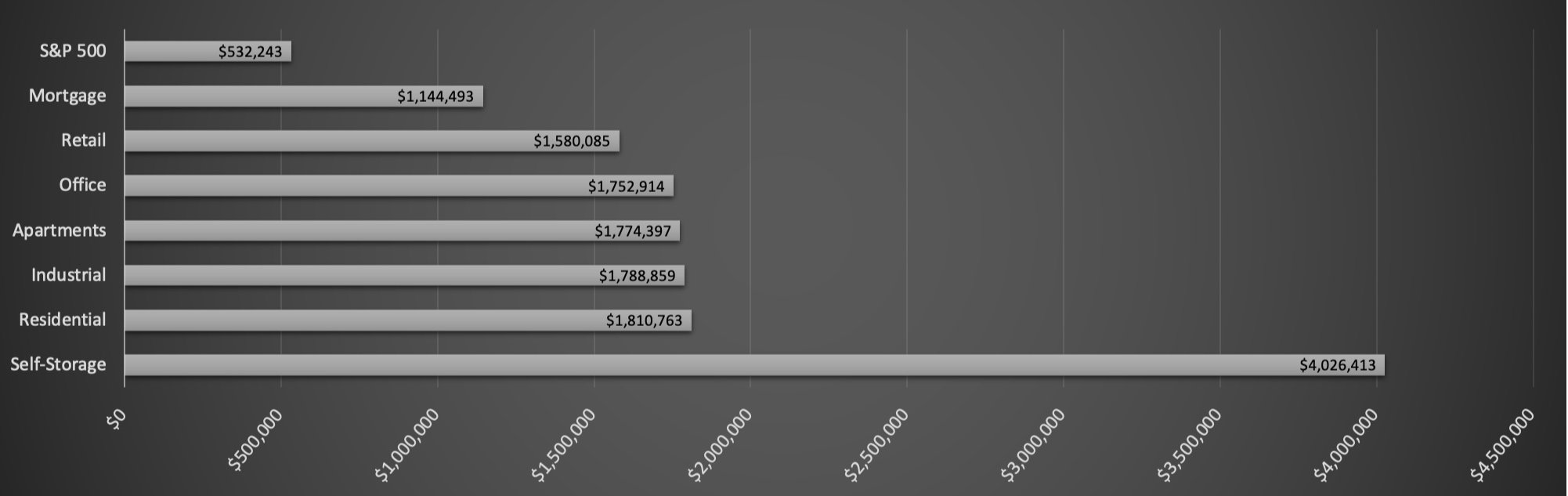

Self storage has the highest return on investment in comparison to any other real estate asset class. From 1994-2017, storage returned an annual average of 17.43%. Based on that annual average, $100,000 invested in 1994 would be over $4,000,000 as of 2017. In comparison, if you invested in apartment buildings over that same time, the $100,000 would be $1,774,397 as of 2017.

2017 Value of $100,000 Invested in 1994 Based on Average Annual Return by REIT Sector

Is self storage recession resilient?

From 2007-2009, self-storage dropped -3.8% in comparison to the S&P’s -22.0%. This was the smallest drop of any real estate asset class. Self storage had some of its best performing years during the COVID-19 Pandemic when some other real estate asset classes performed poorly. According to Trepp, a Commercial Mortgage Backed Securities research firm, of the 1,700 CMBS loans made to self storage in the first 3 quarters of 2020 only 3 were delinquent– that is a 0.17% delinquency rate . During the same time multi-family was defaulting at a rate 1,800% higher or 18x that of self storage.

Do banks like to loan on self storage?

From 2011-2018, self storage had the lowest default rate of any real estate asset class. When those rare few properties did default, the banks only lost an average of 1.52% per default. According to Trepp, a Commercial Mortgage Backed Securities research firm, of the 1,700 CMBS loans made to self storage in the first 3 quarters of 2020 only 3 were delinquent– that is a 0.17% delinquency rate . During the same time multi-family was defaulting at a rate 1,800% higher or 18x that of self storage. Lending on self storage is one of the safest loans a bank can make.

Is self storage easy to manage and operate?

Self storage often has one of the lowest expense ratios of real estate assets due to its minimal staffing requirements, simplified construction, and low turnover costs. By leveraging technology and online tools, self storage facilities can often be operated by a few key employees or even fully automated. The simplified construction of steel and concrete with reduced utilities results in lower ongoing maintenance. When a renter moves out, the turnover cost and process is not like a tenant moving out of an apartment; disposal and broom sweeping are all that are needed in most scenarios.

What is the ownership demographics of self storage?

Of the ~52,000 self storage facilities in the U.S., only 22% are owned by the 6 large REITS, and another 13% are owned by the next 100 largest operations. This leaves about 65% of facilities owned by “mom & pop” operators.

What is the current demand for self-storage units?

The current demand for self-storage units varies depending on various factors such as location, market conditions, and economic trends. Generally, the self-storage industry has seen stable and consistent growth in recent years, driven by factors such as urbanization, lifestyle changes, and the growth of e-commerce. As of 2020, 10.6% of U.S households rent self storage. This is up from 9.4% in 2017. This provides a huge opportunity for growth since in theory, if we were to go from 1 in 10 households using self storage to 2 in 10 households, the national supply of storage facilities would need to potentially double. This sort of growth potential does not exist in many other real estate asset types.

What is the average occupancy rate for self storage?

The average occupancy rate of self-storage facilities varies depending on location, market conditions, and other factors. Typically, the average occupancy rate for self-storage facilities is between 80-90%. However, it is not uncommon for occupancy rates to fluctuate based on seasonal changes and local economic conditions. The self-storage industry as a whole has been stable and consistently growing, with high occupancy rates reflecting the growing demand for storage space.

According to the Self Storage Almanac and Radius+, as of 2022, the national occupancy was 93.4%.

What are the most important factors in buying a self-storage facility?

The most important factors in buying a self-storage facility are:

Location: The location of the self-storage facility is critical in determining its success. Factors to consider include population density, economic conditions, competition, and accessibility.

Occupancy and Rent Rates: The occupancy and rent rates of the facility will have a direct impact on its revenue and profitability. It's important to research the current and projected market conditions to determine the potential for growth.

Operating Costs: The operating costs for a self-storage facility include utilities, insurance, maintenance, marketing, and management. It's important to have a clear understanding of the operating costs before purchasing a facility, to ensure that the revenue from the facility will be sufficient to cover these costs and generate a profit.

Physical Condition: The physical condition of the self-storage facility is also an important factor to consider when buying. Factors to consider include the condition of the buildings and grounds, security features, and any necessary repairs or upgrades that may be required.

Legal and Regulatory Environment: The legal and regulatory environment of the self-storage industry can vary widely by location. It's important to research and understand any local zoning, permitting, and licensing requirements before buying a facility.

Management Team: The management team is critical to the success of the self-storage facility. It's important to have a clear understanding of the management structure, experience, and skills of the current management team, or to consider hiring a management company if necessary.

Financing Options: The financing options for a self-storage facility can vary widely depending on the type of facility, its size, location, and financial condition. It's important to research and understand the financing options available and to work with a lender that has experience in the self-storage industry.

What is the difference between Reg D 506(b) and 506(c) syndications?

Reg D 506(b) and Reg D 506(c) are two different exemptions from SEC registration requirements for private offerings. The main difference between the two is the method of marketing and advertising the investment to potential investors.

Reg D 506(b): Reg D 506(b) allows companies to offer and sell securities to an unlimited number of accredited investors and up to 35 non-accredited investors, but with some restrictions on advertising and general solicitation. In other words, under 506(b), companies cannot use publicly accessible means (e.g. advertisements, public websites) to advertise their investment offerings, but they can approach potential investors through personal and other non-public means.

Reg D 506(c): Reg D 506(c) allows companies to engage in general solicitation and advertising of their investment offerings, but requires that all investors be accredited. In other words, companies can use publicly accessible means to advertise their investment offerings, but they must take reasonable steps to verify that all investors are accredited before accepting their investment.

In general, Reg D 506(c) is considered a more flexible option for companies looking to raise capital, as it allows for a wider range of potential investors and greater marketing and advertising flexibility. However, the requirement to verify that all investors are accredited can add additional administrative costs and responsibilities to the investment process.

Which real estate asset class performs best in a recession?

It is difficult to determine which real estate asset class will perform best during a recession, as real estate markets are influenced by many factors, including the overall economy, local market conditions, and the specific asset type. However, the following 4 asset classes are generally considered to be more resilient during a recession, with one clear winner.

Essential use properties: Properties with essential uses such as supermarkets, drug stores, and grocery stores tend to be more resilient during a recession as people still need to purchase necessities even during tough economic times.

Multi-Family Housing: The demand for rental housing typically remains relatively stable during a recession, making multi-family housing a relatively safe investment during tough economic times.

Industrial Properties: Industrial properties such as warehouses and distribution centers are often less affected by a recession, as the demand for goods and services continues even during a downturn.

Self-Storage: Self-storage facilities are considered to be the most recession resilient real estate asset. People may need to store their belongings due to downsizing or other economic factors. Historically, self storage has performed the best of any real estate asset in recessions. From 2007-2009, self-storage dropped -3.8% in comparison to the S&P’s -22.0%. This was the smallest drop of any real estate asset class. Self storage had some of its best performing years during the COVID-19 Pandemic when some other real estate asset classes performed poorly. According to Trepp, a Commercial Mortgage Backed Securities research firm, of the 1,700 CMBS loans made to self storage in the first 3 quarters of 2020 only 3 were delinquent– that is a 0.17% delinquency rate . During the same time multi-family was defaulting at a rate 1,800% higher or 18x that of self storage. Self storage has the highest return on investment in comparison to any other real estate asset class. From 1994-2017, storage returned an annual average of 17.43%. Based on that annual average, $100,000 invested in 1994 would be over $4,000,000 today.

It is important to note that real estate performance during a recession can vary widely depending on the specific asset and market conditions. Additionally, a recession can result in a decrease in property values, which may impact real estate investors negatively. It is always advisable to conduct thorough research and consult with a professional before making any real estate investment decisions.